Quarter 2 of 2024 saw the top Australian law firms[1] losing slightly more lawyers than theyŌĆÖre hiring with every 1 lawyer leaving seeing only 0.82 lawyers hired. This is a significant change when compared to quarter 1, which saw the top law firms hire twice as many lawyers as they lost. Consequently, the top firms in quarter 2 are showing a more considered approach to hiring than previously.

Hires

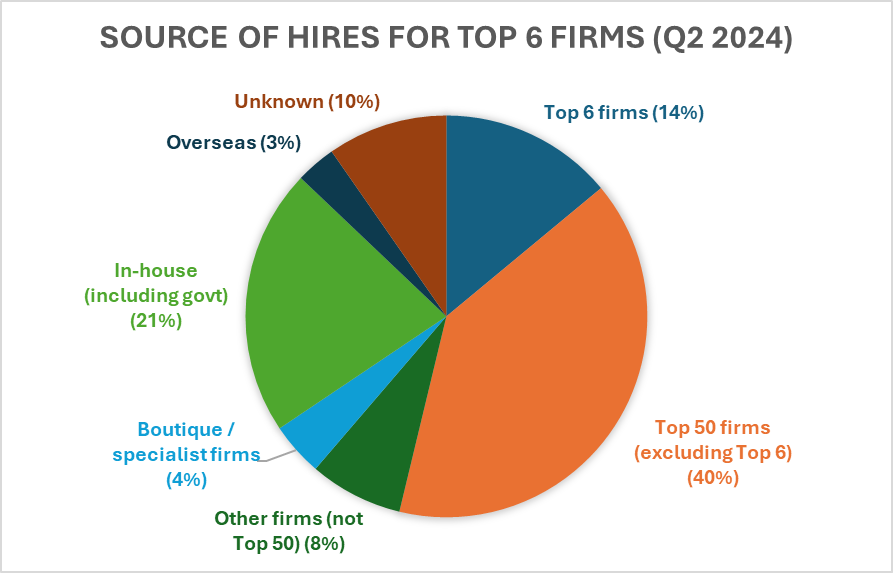

As shown above, the biggest source of hires for the top six firms were top 50 firms (excluding the top 6) (40%) and in-house (21%). Of the hires made in quarter 2, alumni hires made up 13.3% of them, which is a noticeable decrease from quarter 1 where 30% of hires were alumni.

The most sought-after practice areas and PAE continue the quarter 1 trends with the most hires having corporate and commercial, and litigation and dispute resolution experience. The next most sought-after practice areas were property and real estate, and finance, the same trend to quarter 1.

While the most sought after PAE group is the intermediate level lawyers at 3-7 PAE (43% of hires in Q2), weŌĆÖve seen a notable uptake in the hiring of senior talent with 11+ PAE (24% of new hires in Q2 v 13% of new hires in Q1 this year). This is a talent pool that can be particularly difficult to move.

Hiring from within their market

Based on the Insource data, we can see that the most hires in quarter 2 came from the domestic market, whether thatŌĆÖs a top 50 firm or in-house role. The small number of overseas candidates (whether returnees or overseas qualified) shows that this is not a prolific source of talent for the top six firms.

As noted in Beacon LegalŌĆÖs Salary and Market Report, ŌĆ£there is some interest in hiring internationally, however, given additional costs around relocation, sponsorship and re-qualification, the focus has been on domestically trained and based candidates.ŌĆØ

Instead, Australia is following the top New Zealand firms quarter 1 trend of being more considered in their hiring practices. Australian law firms are likely showing some caution around ensuring a business case exists for each new hire rather than automatically filling seats that become vacant. The Insource data supports this as firms are not hiring at replacement levels.

Another contributing factor to the more considered approach, as Elvira Naiman pointed out in a recent Lawyers Weekly Show podcast, is the declining economic market (with a tight market, inflation, increased costs of living and economists predicting a recession) that plays into a conservative mindset. The result is that law firms are doing recruitment on an ŌĆ£as needsŌĆØ basis and any new hire needs to tick all the boxes the firm is looking for. If not, the firms are not proceeding with an offer.

Departures

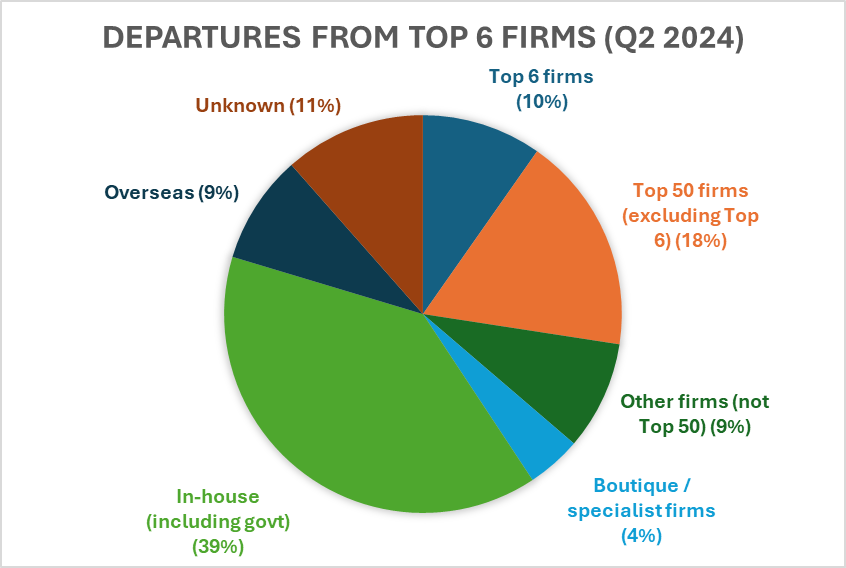

Of the lawyers who left the top six firms in quarter 2, most went to in-house roles (39%) or to another top 50 firm (including top 6 firms) (28%).

The rate of these top drawer lawyers heading overseas has also slightly dropped in quarter 2 (9% from 12% in quarter 1), and continues to be a small portion of where lawyers are leaving the top firms for.

Invest in retention

The Insource data supports the proposition that the talent leaving the top six law firms are seeking a change in firm/role rather than location. They are not heading overseas in large numbers and are instead opting for domestic roles for either a change of lifestyle (in-house) or into another top firm.

For law firms looking to optimise their recruitment, investing in effective retention strategies has never been more important. As stated in a recent Lawyers Weekly article, post-pandemic more firms than ever are ŌĆ£adopting people-centric strategies, prioritising culture, professional development, flexible working arrangements, and increased parental leave entitlements.ŌĆØ

Olivia Holmes, chief people officer at Macpherson Kelley (also an Insource customer), stated in the article that ŌĆ£Law firms need to get serious about understanding what matters to their people and deliver a genuine and holistic employee value proposition ŌĆō not just a work experience.ŌĆØ

For all law firms, itŌĆÖs vital to understand that effective retention strategies go hand-in-hand with an effective recruitment strategy to attract and retain the top talent. With the legal recruitment market continuing to be challenging and live vacancies taking 6 to 18 months to fill (depending on seniority and how specialised the role is) an effective retention strategy is a must.

Identify talent ahead of the need for it

As the domestic legal market is under pressure from the top firms to find that elusive talent, Insource customers have an advantage in being able to identify and track desirable talent with ease.

The Insource platform enables customers to filter by several factors including PAE, practice area, location and current/previous organisation. Customers are then able to create shortlists of desirable talent, reach out and keep in touch with them for future roles. Taking a proactive approach and prospecting approach to recruitment (compared to a reactive and headhunting approach) means focussing on establishing connections and nurturing relationships with talent who may be open to a future career move to your firm.

If youŌĆÖre interested to explore how Insource can assist your firm in making effective and quality hires, donŌĆÖt hesitate to reach out to us and book in a demo. WeŌĆÖre here to empower you to take control of your recruitment and enable you with the fastest way to hire the right talent for your needs.

[1] Allens, Ashurst, Clayton Utz, Herbert Smith Freehills, King & Wood Mallesons, Minter Ellison.